Modeling Margins Like a Hedge Fund Pro

4-Step Framework (Modeling Gross Margins): Fixed vs Variable + Layers!

Today, we cover a 4-step framework that top hedge fund analysts use to model gross margins.

We have already gone through numerous examples and understand the importance of granularity and researchability when modeling revenue - you want to be granular enough to capture inflections/mix shifts/drivers, but not so granular that you can’t accurately research your line items and end up introducing unnecessary error into your key forecasts and ultimately your valuation.

The second part of the modeling equation is margins (e.g., Classic Long/Short Frameworks: How Margins Make or Break Retail Stocks). When modeling margins, you can take previous period’s COGS and SG&A as percentages of revenue and roll them forward:

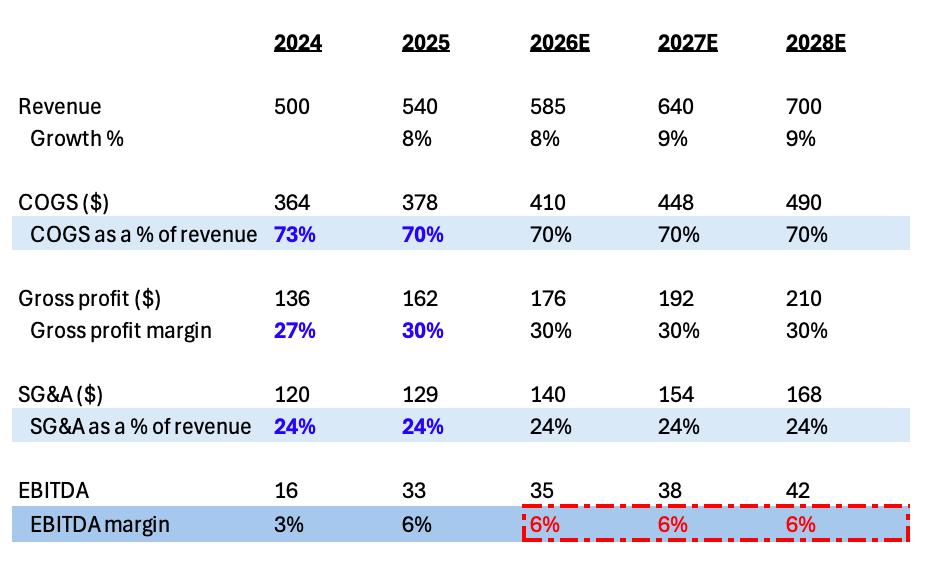

Table 1.

But by treating all costs as variable, you are assuming every dollar of revenue brings an equal dollar of cost. That’s just not how real businesses scale.

Instead, you can split costs into fixed vs variable. Fixed costs grow very slowly, perhaps with inflation, while variable costs scale with revenue:

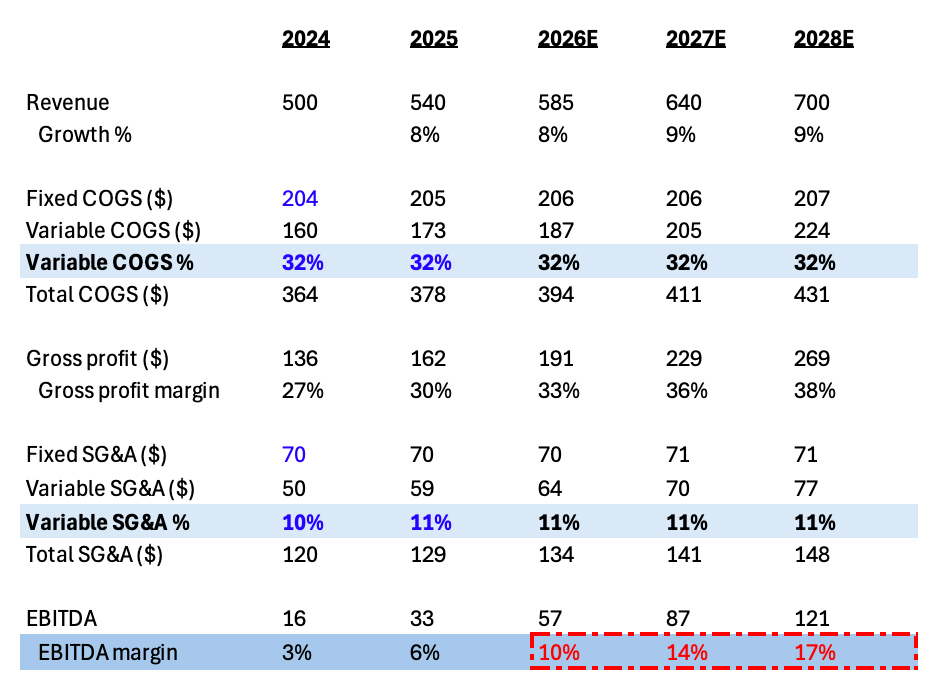

Table 2.

That small structural change of splitting fixed vs variable costs compounds quickly. As revenue grows 8-9% per year, those mostly fixed dollars get spread over a larger base. Then you see gross margins expanding from 30% to 38% and EBITDA margins climbing from 6% to 17%.

That 6% → 17% jump happens precisely because the cost base is only partially variable. Since a portion of the cost base stays fixed, each incremental dollar of revenue flows disproportionately to profit. In other words, you are seeing leverage on a partially fixed cost base (an important feature of operating leverage). In table 1, EBITDA margin stays flat at 6% because you treat all costs as variable.

Modeling margins generally comes down to identifying fixed and variable costs and/or deeply understanding the components of COGS and SG&A. Let’s dive deeper and define a 4-step framework that top hedge fund analysts use to model gross margins. Before we get into it, we need to discuss a few important caveats.

Read previous write-up: Ex-Citadel Top PM: Deep Dive into His Investment Process