NEW: Financial Modeling Videos - Core Drivers & Variant View

Model build, the right granularity, core drivers, stock ideas

New full video on the modeling framework we discussed last time, applied to an example, is now out on phoenixlearning.io.

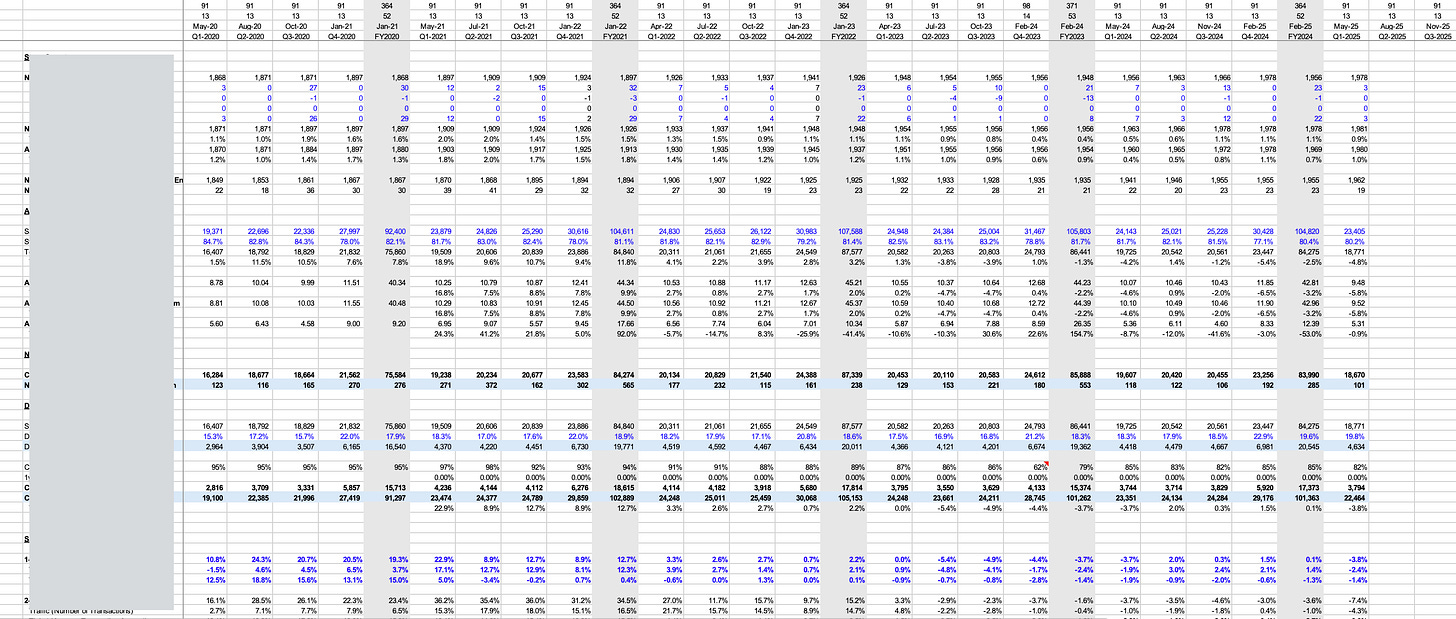

In the previous write-up, Modeling like a top HF analyst, we covered an example and a few powerful frameworks to model revenue, but I wanted to show you how it’s done directly in excel and give you an insight into what these HF models actually look like, the exact steps top analysts go through and the questions they ask themselves to get to the right drivers and level of granularity. Most of what I see out there is either overly granular (and gets lost in the weeds) or way too high-level and hand-wavy.

You can watch the full video and download the excel file here:

Most successful PM/analyst teams have these detailed model builds that they consistently update. They are important because without them, you will never be able to build a repeatable process that produces high-quality ideas.

It’s really about putting the pieces of the puzzle together in a way that makes sense and allows for accurate predictions - how the business works, what metrics to use to assess performance (how the company defines them vs peers), what its core drivers are, what characteristics differentiate it from other players in the sector, how all that shapes the way you develop ideas:

Have you broken down the right core business drivers into something you can actually predict?

What are the exact drivers you need to be researching to get a variant view?

Once you’ve researched them, how do you express your view in valuation terms?

What’s already priced in?

The right model builds help you answer all of these questions and more. It might not sound like the most exciting part, but it sets up your process to identify changes in the business and quantify them.

Some exciting write-ups coming up that I can’t wait to share with you… See you soon.