A great way to drive meaningful differentiated view on a stock is to identify major revenue segment shifts that are likely to significantly impact the margin and growth structures of the company.

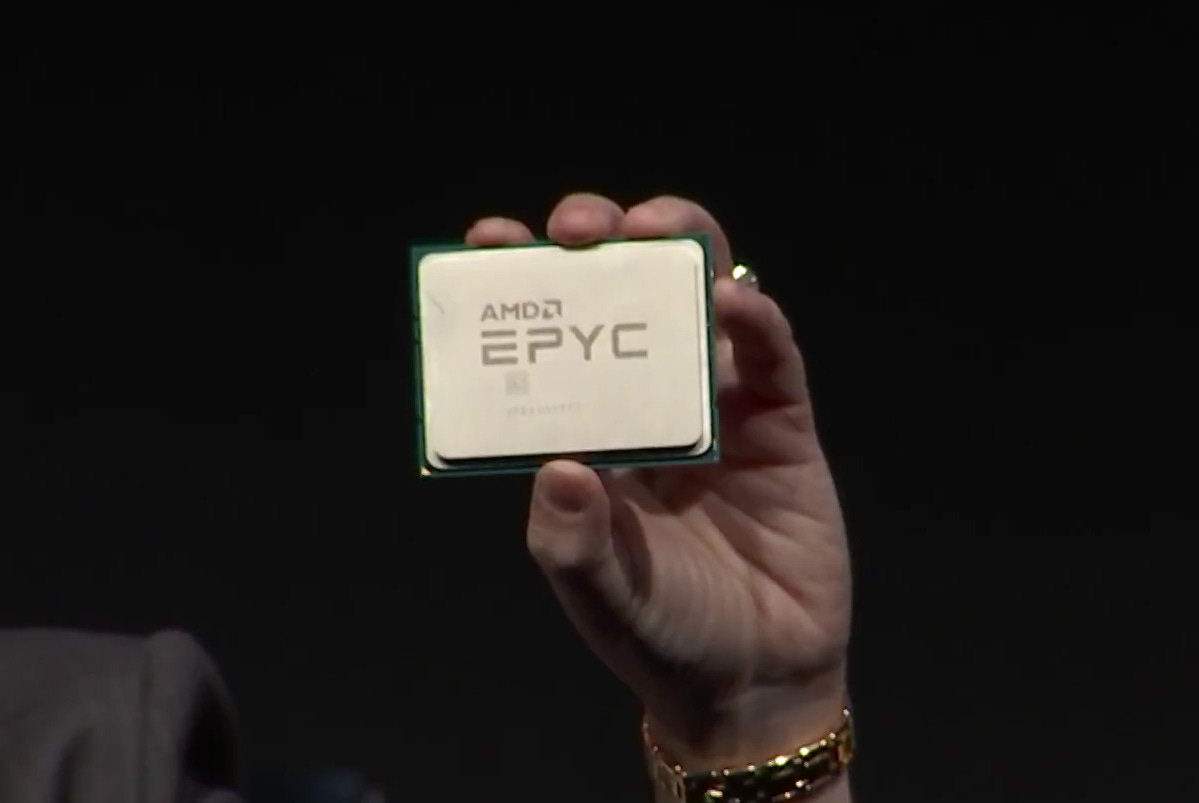

The best way to illustrate this idea generation framework is through a mini case study on AMD, a global semiconductor company, and how the stock tripled as a result of a notable inflection in its revenue mix due to market share gains.

You might have heard great investors talk about detecting change as a source of alpha. This is a prime example of that.

This framework will be incredibly useful to you, and you can apply it yourself, whether you are in the seat or preparing for a case study.

Let’s break it down in an understandable way.

We will first have to get familiar with AMD. I will keep it as brief and simple as possible, so stick with me.